Table of Content

ICB Solutions partners with a private company, Mortgage Research Center, LLC, (nmls # 1907), that provides mortgage information and connects homebuyers with lenders. Neither Mortgageloan.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with any government agency. ICB Solutions and Mortgage Research Center receive compensation for providing marketing services to a select group of companies involved in helping consumers find, buy or refinance homes. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request.

Reach out to Vaster today to start the process of financing your second home before mortgage rates rise even further. Vaster is a mortgage private lender that offers a variety of customized financing solutions for second homes and investment properties. If you’re ready to go, click here to get started on your application. It’s simpler to get a refinance on a second home today, but there still are higher credit requirements. You should have at least a 680 credit score to get the best refinance rates.

Check out our other mortgage and refinance tools

This week, the Federal Housing Finance Agency announced it’s increasing the upfront fees for second-home loans sold to Fannie Mae and Freddie Mac by as much as about 3.9% starting in April. Tierce said that underwriters will first look at where the primary residence is in relationship to the second home. Some borrowers might live outside of the city, and a second home could be a city condo. Underwriters will make sure that the primary house is far enough away to make sense, Tierce said.

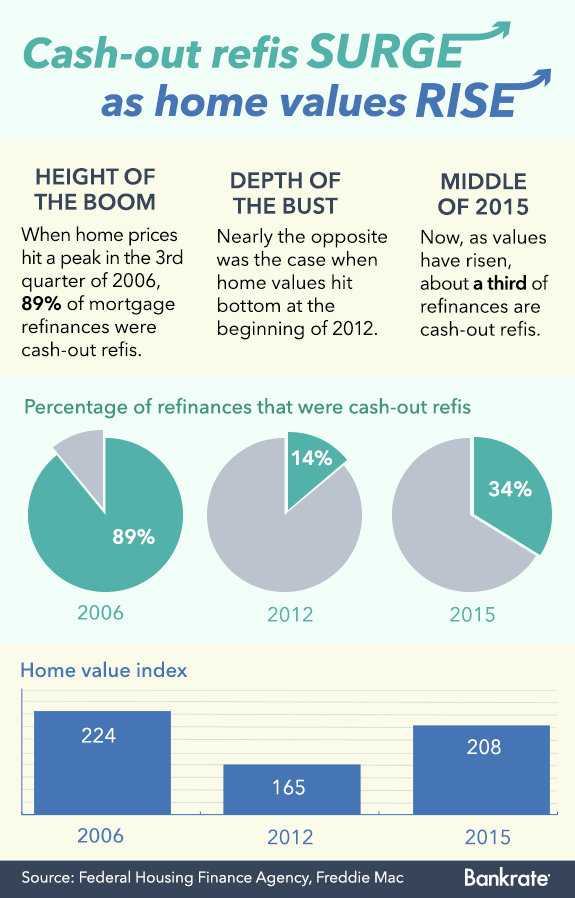

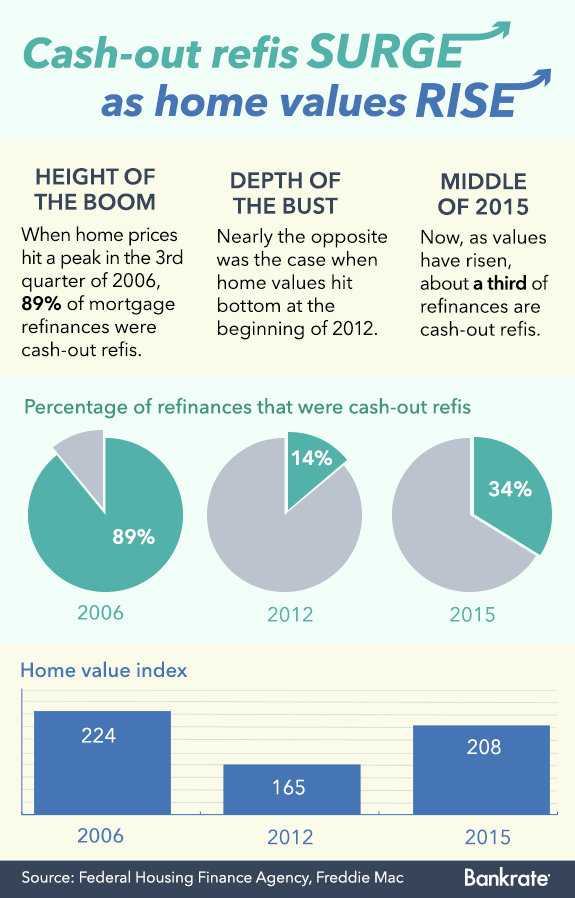

That’s why it’s important to shop around for your second mortgage. Look for lower interest rates and favorable loan terms to get affordable monthly payments. Also, watch out for higher mortgage interest fees — even small increases to your rate can become a burden during the lifetime of a loan. Borrowers who have enough equity in their first home can leverage it to finance a second home. Home buyers can use a cash-out refinance, home equity loan, or home equity line of credit to pull equity from their current property.

Second home mortgage rates explained

"You don't rent any portion of it out for any amount of time," Jensen said. When you're ready to buy a second home, then, it's important to know whether you're purchasing a second home or an investment property. An example of these conditions being met is a second home that you rent out for 200 days in a year and live in for at least 20 days in the year. Meeting these conditions ensures that the house qualifies for a second home mortgage.

Applying for a second home mortgage is similar to applying for a primary residence mortgage. You will, however, have to meet stricter guidelines and be willing to accept a slightly higher mortgage interest rate in some cases. Since you’re not living in this home most of the time, it might not be your first priority for repayment, making the loan riskier for the lender.

Why second home mortgage rates are higher

When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget. In general, lenders consider investment properties to pose a higher risk than loans for principal residences or even vacation homes. There is a belief that the renters who live on the property might potentially ignore maintenance issues or exacerbate existing ones. Also, in financially challenging times, lenders may worry that you’ll prioritize paying down your primary home over the investment property—a legitimate concern. To ensure the investment property is generating income , a lender may even request to see a lease or rent schedule to prove that you are engaged in the process and planning to rent the property.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Maintenance and repairs are a constant — and costly — reality for homeowners.

Check investment property and second home mortgage rates today

In addition, whenever the selling year arrives, an investment property owner can be subject to income tax if the sale results in a profit, Pepper says. The mortgage interest on a second home is tax-deductible so long as it falls within the $750,000 total debt limit and you don’t rent out the property for more than 14 days per year. Making the distinction between a second home and investment property is important not only for tax purposes, but also for when you seek financing for the home.

You’ll probably need to spend more time finding a lender who will refinance the property at an attractive rate, but it’s still possible. Annual Percentage Rate represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after the closing date for adjustable-rate mortgage loans. While these minimums can help you get into a home sooner, the higher your down payment, the lower your mortgage rate and the less you’ll need to pay in mortgage insurance premiums. If you can put 20 percent down, you won’t pay any mortgage insurance at all, and likely get the most favorable rates.

This process is different and so are the mortgage rates for this kind of loan. A second home is not a primary residence, so lenders see more risk and charge higher interest rates. The interest rate on your second home should be less than half a percent higher than what you’d qualify for on a primary home loan.

Please see our Privacy Policy for more information and details on how to opt out. But if you need a second mortgage in order to buy it, be prepared for tougher underwriting requirements and to provide a larger minimum down payment than on your first mortgage. This week, Freddie Mac said the average interest on a 30-year fixed-rate mortgage crept up to 3.22% — still very low.

A personal residence is any home you own that is not classified as an investment property. If your home would be classified as a rental property, you could still deduct the mortgage interest you pay on that property, but the rules and requirements are different. The mortgage interest deduction is a popular tax break that allows homeowners to write off the home loan interest they pay each year. To offset their new costs, lenders will likely raise the interest rates on these loans in this scenario.

No comments:

Post a Comment